We offer services and seminars to help you take control of your finances.

Fall 2022 Workshops

Understand your finances, reduce anxiety, and plan for your future. In partnership with Santander Bank, the program consists of five required workshops and two optional workshops and will be offered virtually via Zoom.

Every Wednesday from 5:30 to 7:30 p.m.

Workshop Schedule

Week 1: Basic Banking - September 14

Week 2: Budgeting - September 21

Week 3: Credit - September 28

Week 4: Identity Theft - October 5

Week 5: Introduction to Auto Loans - October 12

Optional Sessions

Week 6: Introduction to home buying - October 19

Week 7: Introduction to small business - October 26

Register Today

To register, contact Edy Lopez at 978-620-4752 or edylopez@glcac.org

Get Help Filing Taxes & Get a Tax Refund

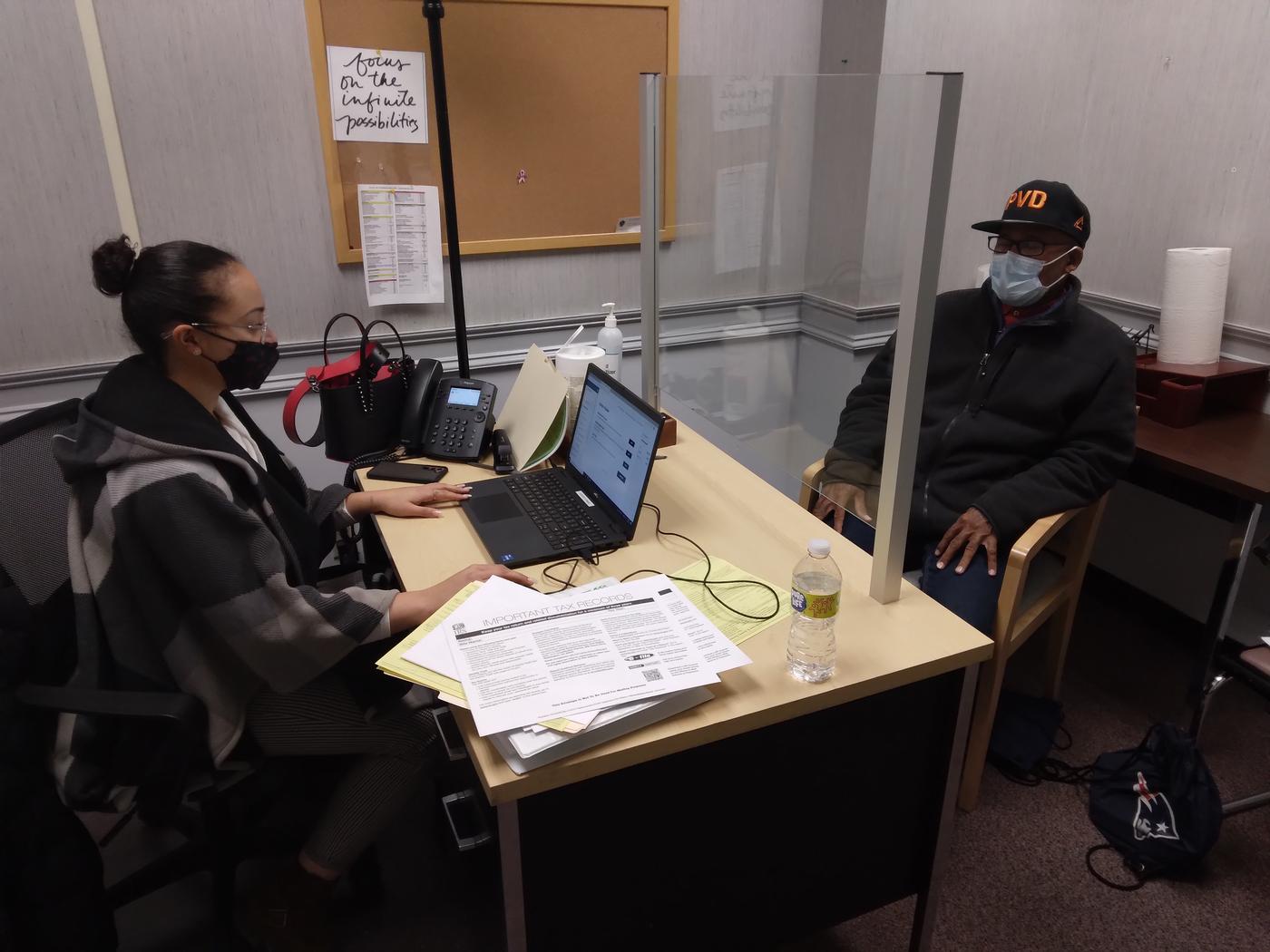

Volunteer Income Tax Assistance Program

Filing tax returns often results in tax refunds for low-income individuals. This can mean extra money to pay overdue bills, provide for families or save for the future.

What is VITA?

Our Volunteer Income Tax Assistance (VITA) program is a team of volunteers that helps qualified individuals file federal and state income taxes. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. The programs run from Feb. 1 through April 15. In 2023, individuals and families earning $60,000 or less are eligible to participate in the VITA program.

Who qualifies for VITA?

VITA is available to qualifying individuals generally earning $57,000 or less, persons with disabilities and limited-English-speaking taxpayers.

How do I participate?

Call to make an appointment for tax assistance. Call Edy Lopez at 978-620-4752, Monday through Friday, 9 a.m. to 3 p.m.

What do I need to bring to my appointment?

Clients need to provide copies of the following documents:

· Proof of identification – photo ID

· Social Security cards for the client, client’s spouse and any dependents.

· Wage and earning statement(s): Form W-2, W-2G, 1099-R, 1099-Misc from all employers.

· 1099G unemployment form

· 1099-INT bank interest earned, if applicable

· A copy of last year’s federal and state returns, if available

· Forms 1095 A, B, and C, health coverage statement

· Letter 6419 Advance child tax credit (NEW)

· Letter 6475 Economic impact payments (NEW)